Average student income in Australia

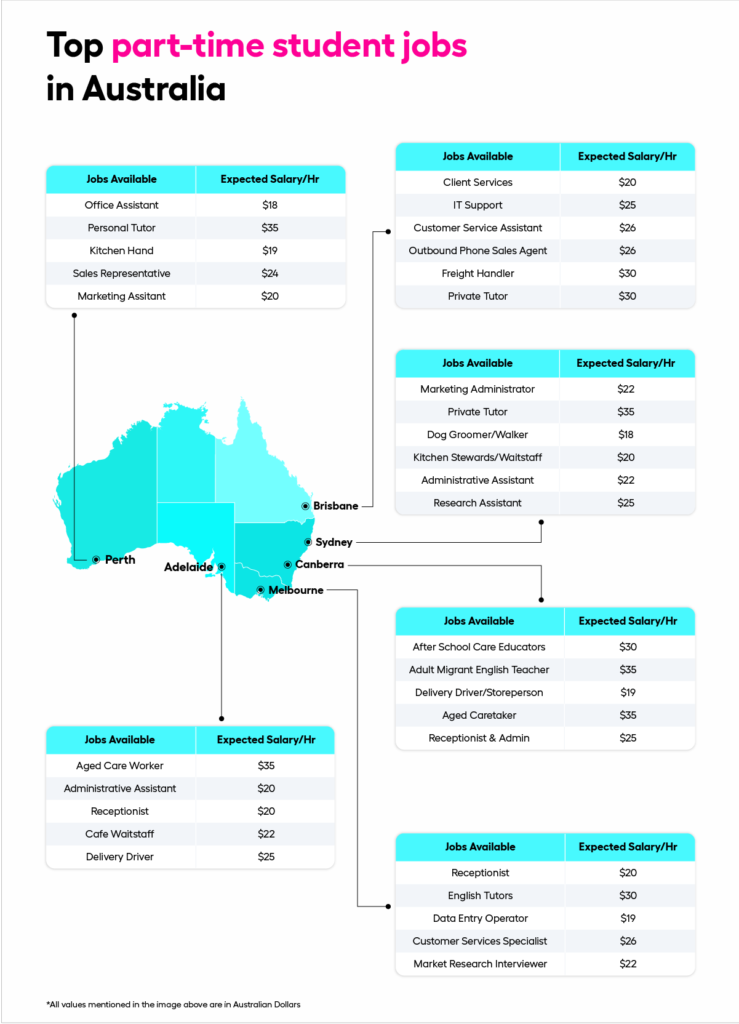

For students who have applied to the full-time professional course, an Australian visa allows for a variable amount of working hours. Typically, a student is granted a work permit for part-time work during the school year and full-time work during the summer break. In an effort to alleviate the labor shortage, the Australian government permits students to work 40 hours per two weeks in any type of employment and has provided little information regarding student visas. Students must manage their employment and academic lives even though they have the ability to work longer hours. It is crucial to finish all assignments on time and turn them in to preserve good ratings. In Australia, students have access to a wide range of career opportunities, including positions in customer service, research assistant, delivery, gasoline station, data entry, and administration. The basic hourly wage in Australia is approximately 21 to 22 AUD per hour, and students can make 800 to 820 AUD per week working both on and off campus. The hourly compensation will vary depending on the job and the locality. Students should search for employment according to factors such as location, the job’s hourly wage, scheduling, shifts, and workload. The various career categories and roles found in Australia, including jobs in retail, restaurants, pubs, hotels, sports arenas, and food stores. We also have jobs in the service sector, such as contact centers, administrative positions, supermarkets, and gas stations, as well as opportunities in the industry, such as monitoring of warehouses and small-scale businesses. The various employment alternatives according to region and hourly wage are listed below. The main thing that students need to remember is that they will be entitled for tax exemptions on computers, educational necessities, and travel, but they will not be able to receive a tax refund if their yearly income exceeds 18,200 AUD. Using PAYG, an online payment and refund system that is integrated with the Australian Taxation Office, all of these transactions can be completed remotely.